Staying with Family

- As long as the price is within your budget

- Location (is it near school, highways, shopping mall)

- Environment, security, facilities

- House facing, feng shui, house number

- Staying within the same neighbourhood with other family members

For Investment

- Location, location, location

- Make calculations (don’t just based on your personal preference)

- Aim for rental returns

- Use Keep strategy or Flip Strategy

BE PREPARED WITH YOUR LOAN DOCUMENTATION

Step 1 :

Nett Income (After EPF, Socso, PCB & others) x 60% = Total Instalment

Step 2 :

Total Instalment – Current Instalment = Balance New Instalment

Step 3 :

Balance New Instalment x 200 = Loan Amount

Example:

David’s monthly income is RM5,000 (after deducting EPF, SOCSO, PCB & others)

Currently he is serving his car instalment, monthly RM800 and personal loan RM300

Total instalment = RM1100.

Calculation:

Debt repayment ability: RM5000 x 60% = RM3000

Amount of the new commitment: RM3000 – RM1100 = RM1900

Loan amount possible: RM1900 x 200 = RM380,000

So David can buy a new house whereby the instalment amount is about RM1900 per month. The amount that the bank can loan to him is about RM380,000.

Do not under-estimate the importance of having a professional consultant to assist you when getting a mortgage loan. A good mortgage consultant will help you to prepare your documents in order and submit to the right bank, all these will determine the percentage of success of your mortgage

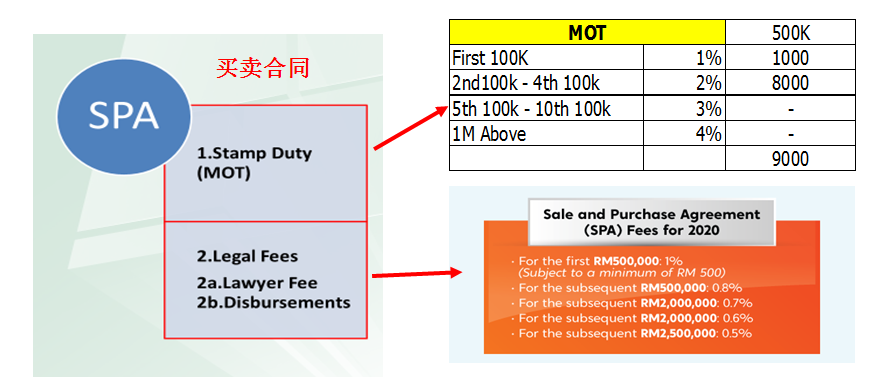

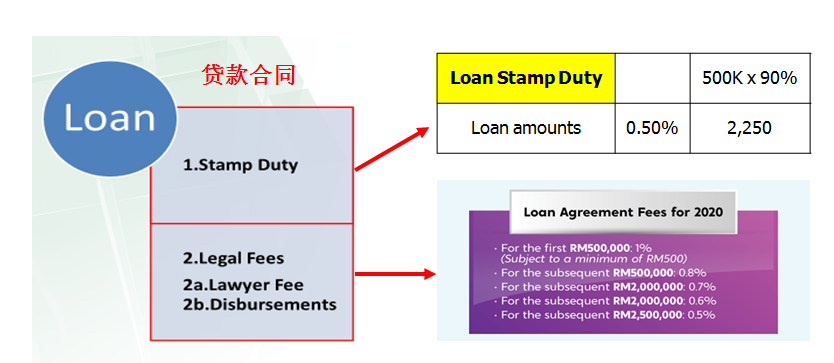

OTHER COSTS

i. SPA related

ii. Loan related

iii. Valuation Report

iv. Water Deposit, Electricity Deposit, Maintenance Fee, Insurance (Fire, MRTA...)

NEW OR SECOND HAND?

New-Developer Sales (Pros):

Everything is new, contemporary design and environment, more trendy

Usually comes with furnishing, thus can save on renovation costs

Some developers offer rebates on stamp duty and other fees

New-Developer Sales (Cons):

Delayed move-in if the project is not completed yet

New area may be quieter

Rental returns not so positive

NEW OR SECOND HAND?

Second Hand House (Pros):

You can survey the environment and condition of the house at a glance, and able to gauge the rental returns, and move-in immediately.

Second Hand House (Cons):

Second hand houses are usually older, and have high maintenance and repair costs. The environment will also be different and lastly the fees incurred will be more expensive.